- 1300 75 77 75

- info@taxbook.com.au

- IB, 2 Portrush Road, Payneham, SA 5070

- 1300 75 77 75

- info@taxbook.com.au

- IB, 2 Portrush Road, Payneham, SA 5070

Archives

Categories

Client Invoicing Policy – Premier Tax & Bookkeeping

Once you have completed preparing an Income Tax Return, Business Activity Statement (BAS) or other services, you must create and issue an invoice via Xero. The invoice must then be emailed to the client for payment.

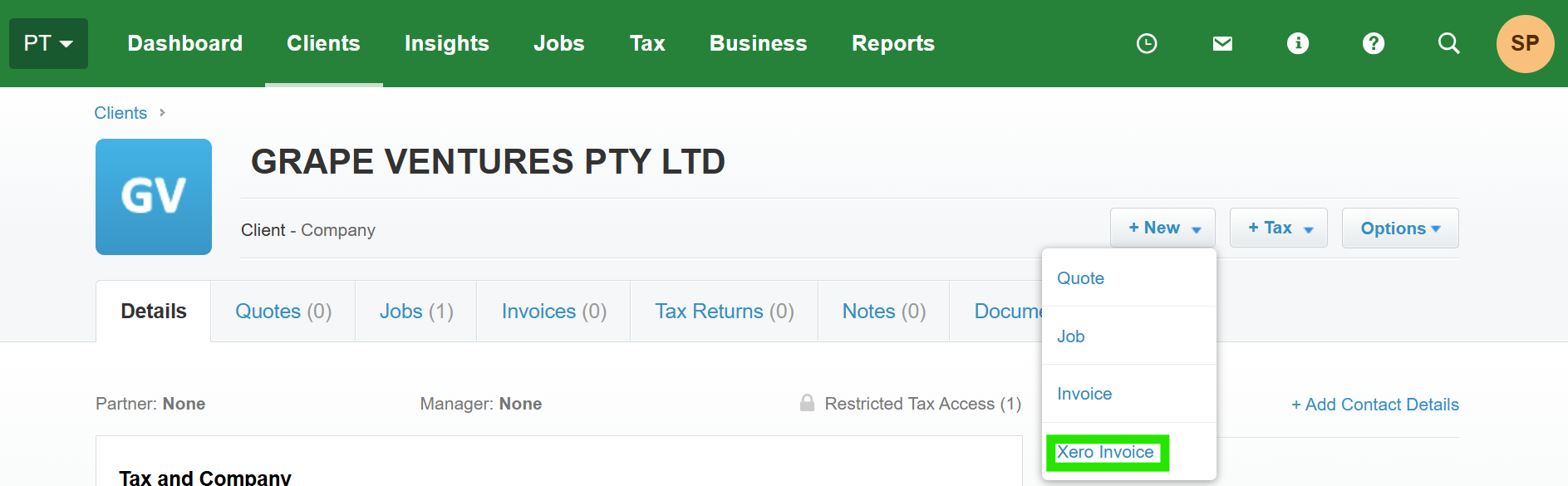

To create an invoice:

- Click on the client’s name in XPM,

- Click on the “New” button

- Select “Xero Invoice” ( Do not select “Invoice” – it must be “Xero Invoice” )

- Complete the invoice fields accordingly

Each individual service must have a separate invoice.

Example:

If you prepare two years of income tax returns for one individual, you must issue two separate invoices, one per year.

This will enable us to calculate your payment accurately

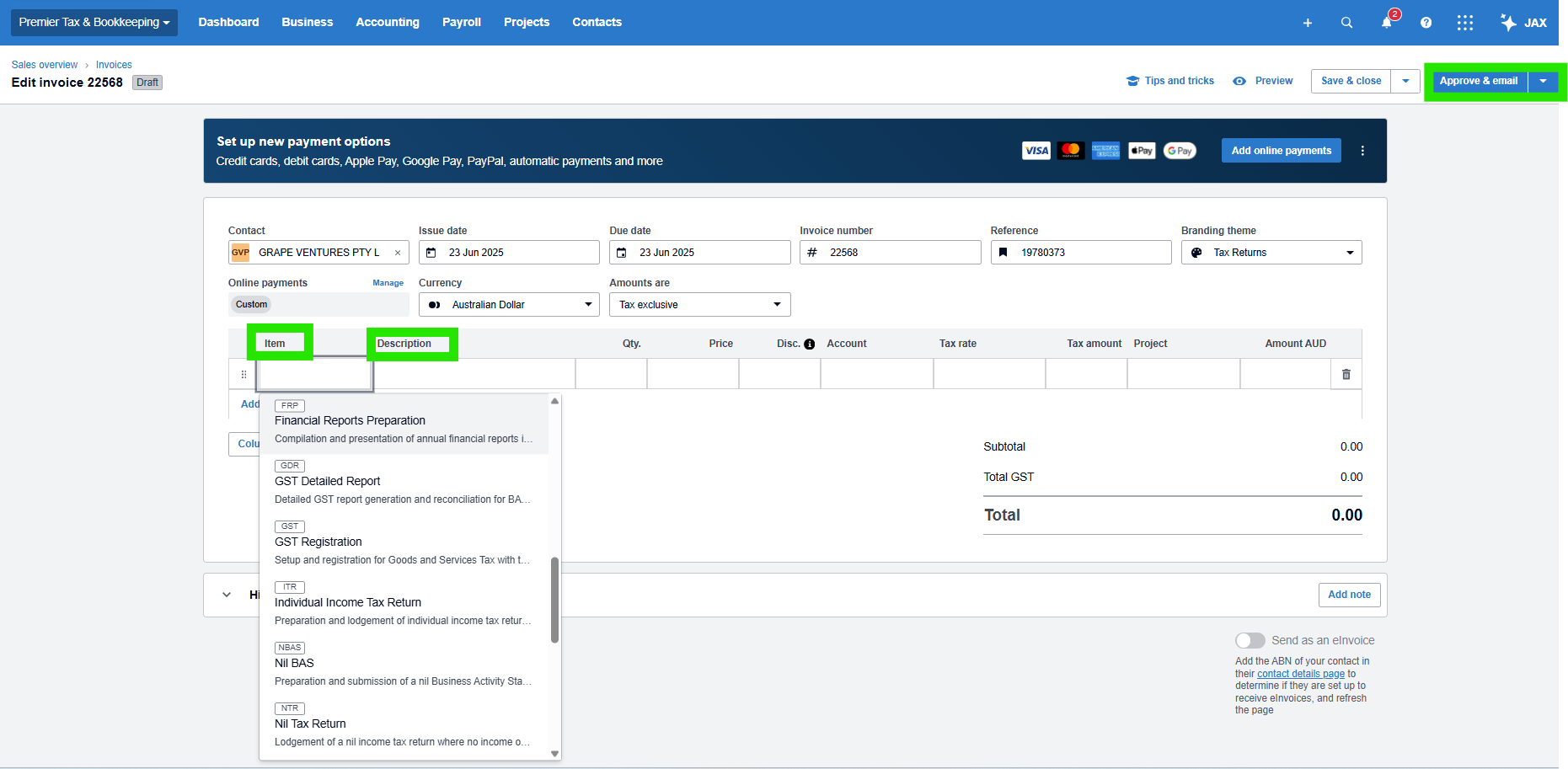

- Use the appropriate item code in the ‘Item’ section of the Xero invoice to match the type of service provided.

- This ensures accurate service categorisation and reporting in XPM.

| Item Code | Item Name |

| ITR | Individual Income Tax Return |

| BAS | Business Activity Statement |

| CTR | Company Income Tax Return |

| TRT | Trust Income Tax Return |

| PTR | Partnership Income Tax Return |

| NTR | Nil Tax Return |

| NBAS | Nil BAS |

| CRS | Company Registration Setup |

| CDR | Company Deregistration |

| TRIT | Trust Registration (Individual Trustee) |

| TRCT | Trust Registration (Corporate Trustee) |

| PRS | Partnership Registration Setup |

| SMSF | SMSF Income Tax Return |

| Item Code | Item Name |

| SBR | Sole Trader Business Registration |

| BNR | Business Name Registration |

| GST | GST Registration |

| PAYG | PAYG Registration |

| DES | Depreciation Schedule |

| FRP | Financial Reports Preparation |

| APP | ATO Payment Plan |

| ABK | Accounting & Bookkeeping |

| ACL | Accountant Letter |

| CGC | CGT Clearance Certificate |

| GDR | GST Detailed Report |

| LASIC | Lodgements to ASIC |

In the ‘Description’ field of the invoice, ensure that you enter the correct tax or BAS period:

- For income tax returns:

Example: “Income Tax Return – FY2025” - For BAS lodgements:

Example: “BAS – March 2025 Quarter”

Once the invoice has been filled out, click “Approve” (as shown in the screenshot)

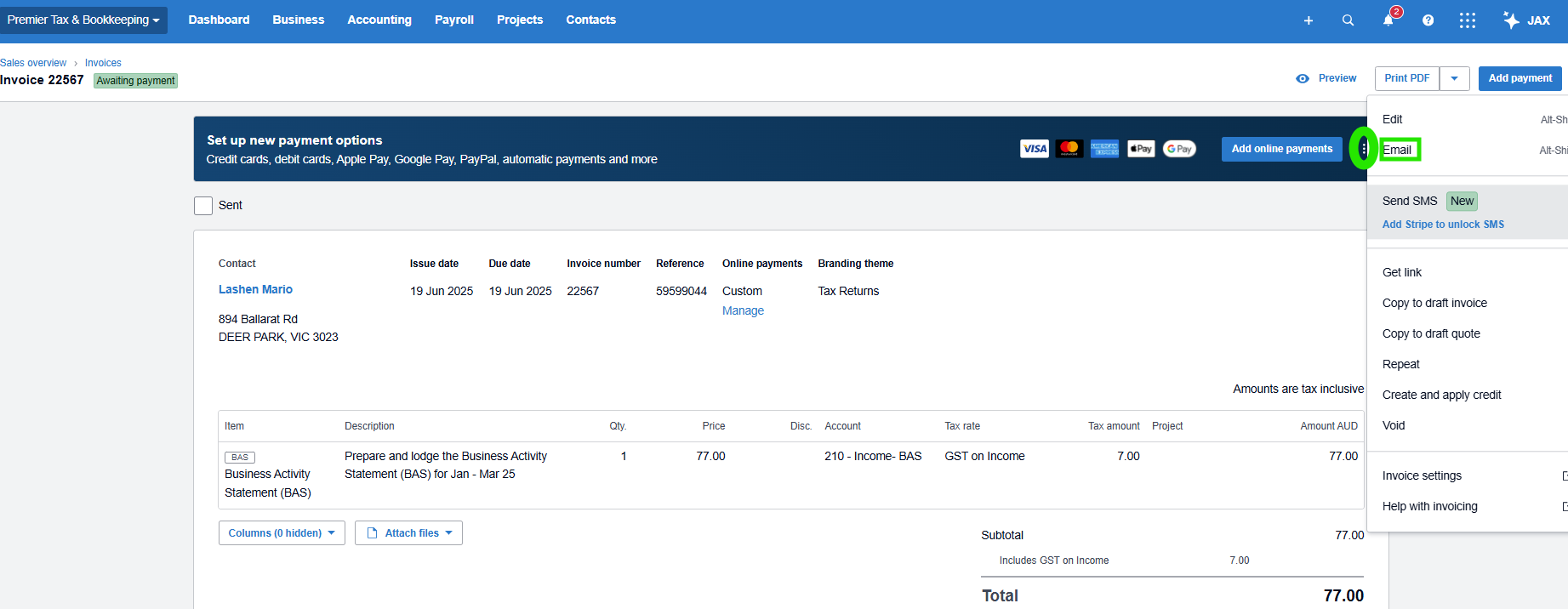

To email the invoice:

- Click the three dots (•••) next to “Add Online Payments”

- Select “Email”

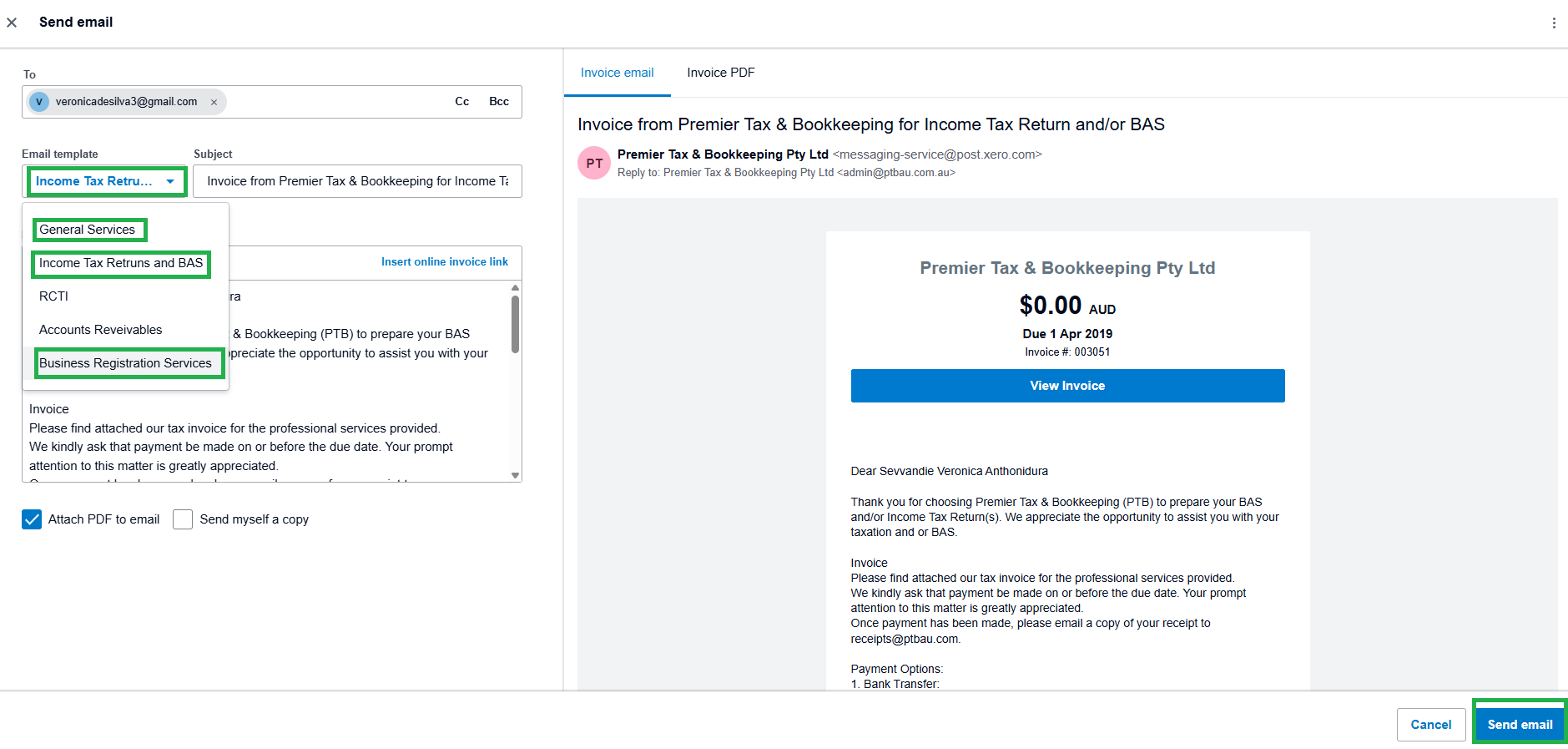

- Choose the correct email template based on the service provided

Available Email Templates:

| Template | Use for: |

| Tax Returns | Individual or business tax return services |

| BAS | All BAS lodgement services |

| Business Registrations | Company setups, ABN, TFN, GST, PAYG registrations |

| General | Any other services not covered in the above categories |

Ensure you always select the correct template before sending. This ensures clients receive clear and accurate information.